Saturday, 29 April 2017

Sunday, 9 April 2017

Cost Center & Work Center Integration!!

What is a Cost center in SAP?

SAP

cost center can be created for each

organization function or department to record the cost incurred which

contribute to a company’s profitability indirectly. Here some of the cost

center categories generally used in SAP

·

Production

·

Sales

·

Administration

·

Service Cost center

In SAP production

planning, each work

center will be assigned to one cost

center. For every activity type defined in a work center, an activity rate will

be maintained in the cost center. SAP system uses this information to calculate

activity cost for an operation.

We can assign a work center to only

one cost center. But we can assign several work centers to one cost center.

Example

Consider a cement making industry

where cement bulk are manufactured from Clinker, Gypsum, Fly Ash, Slag

(Granulated), Limestone etc. A Ball Mill operates on 120 T per day and the

following activities are performed in Ball Mill to make the Bulk cement:

1. Machine hours

2. Labor

hours

3. Setup

hours

In this case, we can define 3

activity types in the work center MILL-1 (Ball Mill - A) and assign them to

work center MILL-1. The work center is assigned to the cost center EX1_PQ_Production.

Activity rate for each activity (Machine hours, Setup hours and labor hours) are maintained against the cost center. Planned Machine hours, Setup hours and labor hours are maintained for the base quantity of 120 T (ball mill capacity) in a routing. Formula for each activity (Machine hours, Setup hours and labor hours) are maintained in a work center.

Activity rate for each activity (Machine hours, Setup hours and labor hours) are maintained against the cost center. Planned Machine hours, Setup hours and labor hours are maintained for the base quantity of 120 T (ball mill capacity) in a routing. Formula for each activity (Machine hours, Setup hours and labor hours) are maintained in a work center.

Activity

Cost Calculation Formula

When a production order is created

in the SAP system, it uses the above information to calculate the activity

cost.

Example of SAP Work Center and SAP

Cost Center Integration

Activity Types in Costing

Activity Types in SAP Cost Centers

Activity Price of Activity type

Activity price will be defined for

each activity type and cost center manually. In this example, even though we

have similar activity types for the cost center, activity price will be

different for the cost center. The activity price is defined in the

transaction KP26.

Activity Cost in Product Costing

In general, product cost in SAP

comprise of three primary components:

1.

Raw material or component cost

2.

Activity cost

3.

Overhead cost

Here, activity cost is calculated

based on work centers, cost centers and activity prices. The SAP system

calculates the activity cost by multiplying the activity price to quantity of

operations.

Example of Activity Cost in Product Costing

Let’s consider an example. A work

center ball mill produces bulk cement for 50 kg Cement Bag. This work center

has the following activities:

1.

Setup

2.

Machine

3.

Labor

SAP Work Center Assignment to SAP

Cost Center

The work center is assigned to the

cost center (3010255001) and each activity (setup, machine and labor) is assigned

with an activity type (MSUSFG, MACSFG and LABSFG).

Now, let’s look at activity price

calculation. Activity prices are maintained for the cost center (3010255001) and

activity types (MACSFG, MSUSFG and LABSFG) in the transaction KP26 by

a controlling person.

Setup Activity Price (Cost Center

3010255001 and Activity Type MSUSFG)

Setup Activity Price (Cost Center

3010255001 and Activity Type MSUSFG)

Labor Activity Price (Cost Center

3010255001 and Activity Type LABSFG)

Next, let’s check routing details of

the material. It will specify how many units of each activity are required for

manufacturing a base quantity of this material.

SAP Routing for a Material

(Transaction CA01)

Now lastly we perform a costing run

for the material in transaction CK11N to see how the SAP

system calculates product cost for this material.

The calculation is performed

according to the following formula:

Machine hour activity cost = Machine

activity price / Unit * Quantity from Formula

Subscribe to:

Comments (Atom)

Featured post

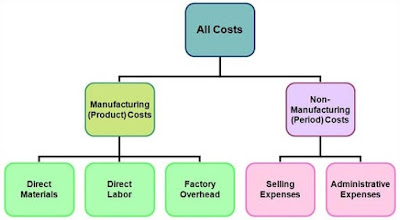

Introduction to manufacturing and non-manufacturing costs!!

A manufacturing company incurs both manufacturing costs (also called product costs) and non-manufacturing costs or expenses (also called ...

-

What is a Cost center in SAP? SAP cost center can be created for each organization function or department to record the cost incurred w...

-

PP-Discrete: Required where there will be discrete orders passing through a work center, here the capacity planning plays major...